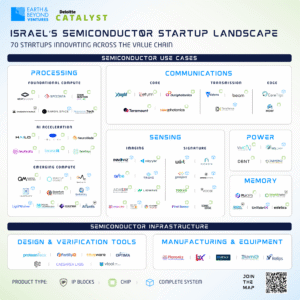

Mapping the 70 Israeli startups shaping the future of semiconductors, AI, and computing

Since IBM and Intel set up R&D centers in Israel in the 1970s, propelling Israel’s semiconductor ecosystem to the next level, there have been over 70 semiconductor startup exits with a cumulative value of $44 billion, according to a study published by Earth & Beyond Ventures and Deloitte Catalyst, which examined the Israeli semiconductor industry. The most prominent among them: Mellanox (acquired by NVIDIA), Mobileye and Habana Labs (acquired by Intel), and Annapurna Labs (acquired by Amazon), showcasing the international interest in Israel’s rich human capital in the industry. Today, about 200 semiconductor companies operate in Israel, employing over 45,000 people. The report includes a mapping of 70 startups in Israel’s semiconductor industry, comprising 26 at growth stages and 44 at early stages, which have collectively raised $5.5 billion since their founding.

The areas of expertise in which the startups are engaged are divided into several categories:

Processing & Compute (22 companies, raised $1.8 billion) – Chips that perform operations to execute instructions and manipulate data. This category includes startups developing chips for AI models and new computing paradigms such as optical, quantum, and neuromorphic computing.

Sensing (17 companies, raised $2 billion) – Chips that detect real-world signals and convert them into digital data.

Communications (10 companies, raised nearly $1 billion) – Chips that enable the transfer and reception of data between devices, systems, or infrastructure.

Memory (5 companies, raised $350 million) – Chips that store or retrieve digital data during computation for near or long-term use.

Power (4 companies, raised $90 million) – Chips that regulate, convert, or manage electrical energy for stable and efficient system operation.

Semiconductor Infrastructure (12 companies, raised $220 million) – Companies driving innovation across the semiconductor manufacturing supply chain.

The global semiconductor industry has undergone dramatic changes in recent years. The acceleration of large AI models demands massive computing power, requiring both large-scale chip production and the development of specialized chips for AI. This need led to NVIDIA’s meteoric rise, with its market value recently surpassing $4 trillion. At the same time, geopolitical relations and global events are reshaping the industry. The COVID-19 crisis caused severe disruptions in global supply chains, leading to major chip shortages in the West, as most production takes place in East Asia. This concentrated market has fueled tensions between the U.S. and China, with the U.S. leading most advanced chip development, while China holds reserves of rare earth metals critical to the industry. These dynamics led to recognition in the West, particularly in the U.S., of the need for independence in chip production, both for commercial reasons and for national security. This understanding drove significant steps and investments to strengthen local industries in the U.S. and across the West.

Despite its small size, Israel has played a central role in the global semiconductor industry over the years. It began with the establishment of R&D centers by major companies such as Intel and IBM in the 1970s, later joined by Qualcomm, Microsoft, Google, and others. These created fertile ground for the growth of numerous startups across the value chain, from chip development and design to testing. The combination of multinational R&D centers leveraging Israel’s strong human capital, together with startups developing solutions across the semiconductor value chain, has made Israel a significant industry player, with many exits, IPOs, and unicorns. Israel is also home to two semiconductor fabrication plants, one owned by Intel and one by Tower Semiconductor.

The future of the semiconductor industry will be shaped by geopolitics, surging demand for AI models, and the ability of nations and companies to build dedicated infrastructure and cultivate human capital. We expect to see substantial growth in semiconductor development and manufacturing investments, from both private capital and governments. The rising use of AI models will likely accelerate innovation in chips designed for these models and, more broadly, across the entire semiconductor value chain. Israel’s strengths and startup-driven innovation, supported by international corporations, position it as a key contributor to the industry. If the Israeli semiconductor industry can overcome its key challenges: competition for talent from other industries, global export restrictions, and the impact of chip manufacturing abroad, particularly in East Asia, we expect its role on the global stage, and in particular its ability to innovate at the startup level, to remain significant.

Amit Harel, Partner & Leader, Deloitte Catalyst: “In an era where technology is a key component and a strategic asset for national security, the semiconductor field is regarded as critical to the ability of global powers and nations to strengthen their standing in the world. The capacity to develop innovative IP, alongside the continuous upgrading of manufacturing and development capabilities for advanced chips, forms the foundation for creating future competitive advantage among nations. Israel has positioned itself as a significant player in this race, yet we must not take our foot off the gas. The state, together with both local and international players, must invest in the field more than ever before, through growth-oriented investments as well as investments in academia and human capital.”

Zack Fagan, Partner, Earth & Beyond Ventures: “Israel’s strengths in core DeepTech verticals such as chip design, advanced materials, and photonics form a critical technological foundation for the next era of the semiconductor industry. The combination of rich human capital and the significant presence of multinational corporations creates fertile ground for innovation to emerge in new and existing Israeli startups. In parallel to this, the growing demand for solutions capable of supporting large-scale AI models is changing perceptions on investments in the domain. While in the past, VC funds were reluctant to enter the sector due to the significant capital required to bring products to market, today we are seeing an increasing number of early-stage investments in the field from a broader range of funds. Taken together, there is reason for optimism about the future of semiconductor startups in Israel.”

Credit photo: Maayan Rahima & Adi Cohen – Tsedek