cline follows an 8% fall in 2015 after setting all-time high in 2014.

IC Insights recently released its Update to the 2016 IC Market Drivers Report that examines and evaluates key existing and emerging end-use applications that will support and propel the IC industry through 2019.

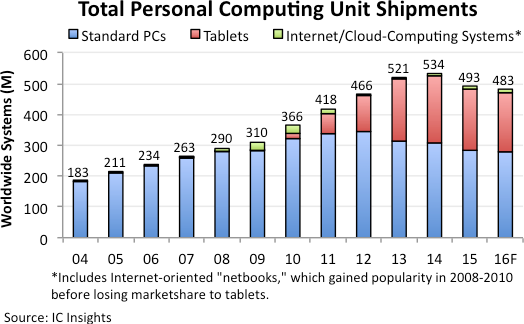

At the mid-point of 2016, it is apparent that the struggling markets for personal computers and tablets continue to spiral downward as more users delay replacement purchases and increase their reliance on smartphones for mobile-computing applications and access to the Internet. Worldwide shipments of PCs and tablets fell by about 10% on an annual basis in the final quarter of 2015 and the declines were nearly that bad in 1Q16. The weak start to 2016 has caused IC Insights to lower its PC and tablet forecasts, with system shipments in these two categories now expected to fall 2% and 4% this year, respectively, versus the previous projection of 0% change in personal computers and a 2% decline in tablets. As seen in Figure 1, total shipments of personal computing devices (PCs, tablets, and Internet/cloud-computing “thin-client” systems) are now forecast to fall to 483 million units this year. Through 2019, IC Insights forecasts that total personal computing unit shipments will now grow at a compound annual growth rate (CAGR) of only 0.1%, compared to the previous 0.7% CAGR projection.

Worldwide shipments of desktop PCs are forecast to slip 2.4% to 119 million units from 122 million in 2015, while notebook computers are forecast to slip 1.2% to 160 million units from 162 million in 2015. Shipments of tablet computers this year are forecast to decline to 192 million from 199 million in 2015.

Only Internet/cloud-computing shipments are forecast to grow in 2016. Shipments of these devices are forecast to rise to 12 million units from 10 million in 2015. These relatively inexpensive systems are often aimed at schools and consumers looking for low-cost alternatives to full-blown PCs but with a wider range of computing capabilities than tablets. Most of today’s Internet/cloud-centric laptops are designed as Chromebook systems, based on platform specifications defined by Google for its Chrome operating system and online applications. Moreover, the spread of cloud-computing services is making more notebook PC users comfortable with the concept of using Internet-connected storage and online application software, which can be run on low-cost Chromebook platforms. Though shipments of Internet/cloud systems are expected to climb through the end of the decade, they are forecast to remain a very small portion of total personal computing unit volume.

Figure 1

Report Details: The 2016 IC Market Drivers Report

Additional details on the market for personal computers and tablets are included in the 2016 Update of IC Insights’ IC Market Drivers—A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits. This report examines the largest, existing system opportunities for ICs and evaluates the potential for new applications that are expected to help fuel the market for ICs through the end of this decade.

IC Market Drivers is divided into two parts. Part 1 provides a detailed forecast of the IC industry by system type, by region, and by IC product type through 2019. In Part 2, IC Market Drivers examines and evaluates key existing and emerging end-use applications that will support and propel the IC industry through 2019. Other system application covered include the Internet of Things, smartphones, personal/mobile computing (including tablets), servers, medical/wearable devices, and a review of many applications to watch—those that may potentially provide significant opportunity for IC suppliers later this decade. IC Market Drivers 2016 is priced at $3,490 for an individual user license and $6,590 for a multi user corporate license.