The O-S-D market segments are growing at above average rates in 2017 and all three are expected to reach new record highs for the first time in six years, says new update.

More than a dozen product categories in optoelectronics, sensors/actuators, and discretes semiconductors (O-S-D) are on track to set record-high annual sales this year, according to a new update of IC Insights’ 2017 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discrete Semiconductors. Driven by the expansion of the Internet of Things (IoT), increasing levels of intelligent embedded controls, and some inventory replenishment in commodity discretes, the diverse O-S-D marketplace is having a banner year with combined sales across all three semiconductor segments expected to grow 10.5% in 2017 to a record-high $75.0 billion, according to the O-S-D Report update.

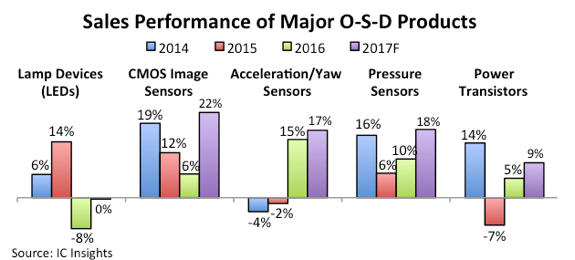

In 2017, above average sales growth rates are being achieved in all but one major O-S-D product category—lamp devices, which are now expected to be flat in 2017 because of continued price erosion in light-emitting diodes (LEDs) for solid-state lighting applications. Figure 1 compares annual growth rates in five major O-S-D product categories, based on the updated 2017 sales projection.

For the first time since 2014, all three O-S-D market segments are on pace to see sales growth in 2017. Moreover, 2017 is expected to be the first year since 2011 when all three O-S-D market segments set record-high annual sales volumes, according to IC Insights’ update.

The 2017 double-digit percent increase will be the highest growth rate for combined O-S-D sales since the strong 2010 recovery from the 2009 semiconductor downturn that coincided with the 2008-2009 financial crisis and global economic recession. Total O-S-D revenues are now forecast to reach a ninth consecutive annual record high level of $80.5 billion in 2018, which will be a 7.4% increase from 2017 sales, says the O-S-D Report update.

After a rare decline of 3.6% in 2016, optoelectronics is recovering this year with sales now projected to grow 8.1% in 2017 to an all-time high of $36.7 billion, thanks to strong double-digit sales increases in CMOS image sensors (+22%), light sensors (+19%), optical-network laser transmitters (+15%), and infrared devices (+14%).

Meanwhile, record-high revenues for sensors and actuators are being fueled by the expansion of IoT and new automated controls in a wide range of systems—including more self-driving features in cars. Sensors/actuator sales are now expected to climb 17.5% in 2017 to $13.9 billion, marking the strongest growth year for this market segment since 2010. Sales of sensors and actuators made with microelectromechanical systems (MEMS) technology are forecast to rise by 18.5% in 2017 to a record-high $11.6 billion. The O-S-D Report update shows all-time high sales being reached in 2017 with strong double-digit growth in actuators (+20%), pressure sensors, including MEMS microphone chips (+18%), and acceleration/yaw sensors (+17%).

Even the commodity-filled discretes market is thriving in 2017 with worldwide sales projected to rise 10.3% to $24.1 billion, which will finally surpass the current peak of $23.4 billion set in 2011. Sales of power transistors, which account for more than half of the discretes market segment, are forecast to grow 9.0% in 2017 to a record-high $14.0 billion, according to the new O-S-D Report update.